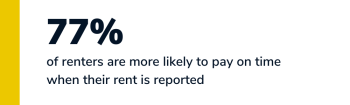

Rental delinquency decreases by up to 50% thus saving you time and energy chasing residents for past due amounts

CredHub is the only solution that reports payment and non-payment every month, providing a more powerful incentive for on-time payments.

Give your residents access to world-class ID theft protection from Allstate.

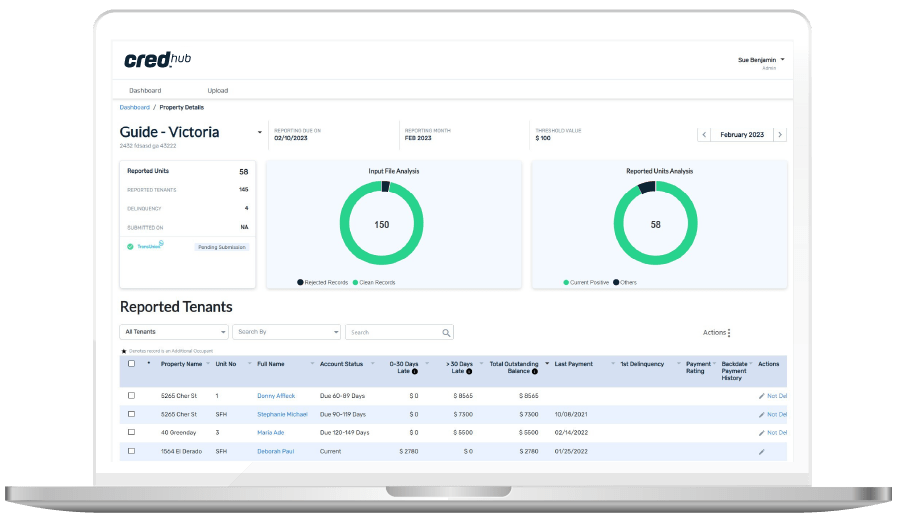

Property managers spend less than 15 min per month managing CredHub.

Industry Solutions

Incomplete Reporting

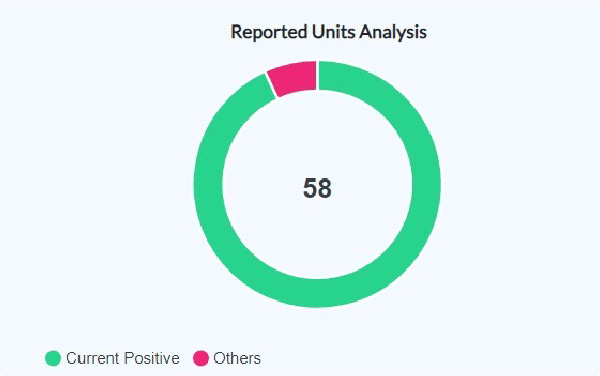

Using incomplete reports will only report the positive data decreasing the incentive to provide rent collections.

Automated Support

Most industry solutions only offer automated bots without any human support for account management.

Additional Cost

These solutions will be an additional monthly or yearly cost to property managers.

Account Management Support

CredHub does the heavy lifting allowing you to make exceptions when needed and communicate with renters.

Earn Revenue

CredHub allows you to build a new revenue stream while helping renters build their credit scores.

Full Reporting

Complete reports lead to more captured revenue and can help with post move-out collections.

Industry Solutions

Incomplete Reporting

Using incomplete reports will only report the positive data decreasing the incentive to provide rent collections.

Full Reporting

Complete reports lead to more captured revenue and can help with post move-out collections.

Automated Support

Most industry solutions only offer automated bots without any human support for account management.

Account Management Support

CredHub does the heavy lifting allowing you to make exceptions when needed and communicate with renters.

Additional Cost

These solutions will be an additional monthly or yearly cost to property managers.

Earn Revenue

CredHub allows you to build a new revenue stream while helping renters build their credit scores.

The CredHub team will organize a kick off call to connect with your Property Management System.

CredHub establishes a tradeline with bureaus to be able to report for your renters on your behalf.

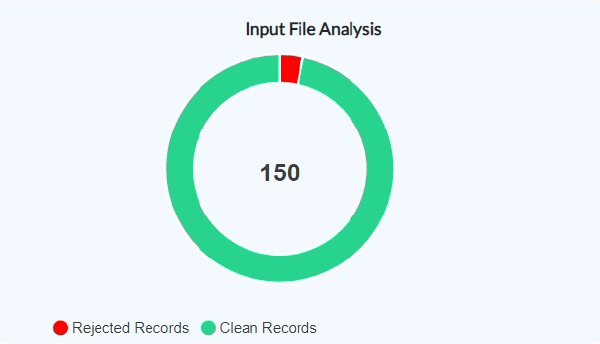

During the first few months we will review your renter data with you prior to submitting to the bureaus.

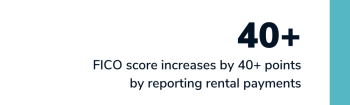

CredHub is credentialed to report to Equifax, TransUnion and Experian. Critical to CredHub helping reduce payment delinquency for property managers is reporting late and skipped payments. Both Equifax and TransUnion accept late and skipped payments as a factor in resident credit scores.

The CredHub platform is flexible, scalable, and can work with any property management system.

CredHub seamlessly and securely extracts the data each month for our partners property management system. We upload it to our portal, where all you need to do, property manager, each month is review it. It takes less than 15 minutes per month. After you have reviewed data, the information is automatically transformed into each bureau’s proprietary format and reported to the credit bureaus.

Property managers and landlords of all sizes can now have a relationship with the major credit bureaus by partnering with CredHub. CredHub does require a minimum of 50 units to get started.

CredHub will do the work to get your company up and running with the credit bureaus. It takes approximately three to six weeks to establish a tradeline.

Schedule a demo to learn more about CredHub’s solution or get started now!