Improve renter satisfaction

Collect more rent

Increase your bottom line

The CredHub team will organize a kick off call to connect with your Property Management System.

CredHub establishes a tradeline with bureaus to be able to report for your renters on your behalf.

During the first few months of onboarding we will review your renter data with you prior to submitting to the bureaus.

Give your residents access to world-class ID theft protection from Allstate.

Property managers spend less than 15 min per month managing CredHub.

Industry Solutions

Incomplete Reporting

Using incomplete reports will only report the positive data decreasing the incentive to provide rent collections.

Automated Support

Most industry solutions only offer automated bots without any human support for account management.

Additional Cost

These solutions will be an additional monthly or yearly cost to property managers.

Account Management Support

CredHub does the heavy lifting allowing you to make exceptions when needed and communicate with renters.

Earn Revenue

CredHub allows you to build a new revenue stream while helping renters build their credit scores.

Full Reporting

Complete reports lead to more captured revenue and can help with post move-out collections.

Industry Solutions

Incomplete Reporting

Using incomplete reports will only report the positive data decreasing the incentive to provide rent collections.

Full Reporting

Complete reports lead to more captured revenue and can help with post move-out collections.

Automated Support

Most industry solutions only offer automated bots without any human support for account management.

Account Management Support

CredHub does the heavy lifting allowing you to make exceptions when needed and communicate with renters.

Additional Cost

These solutions will be an additional monthly or yearly cost to property managers.

Earn Revenue

CredHub allows you to build a new revenue stream while helping renters build their credit scores.

Effective July 1, 2021 senate bill 1157 states that all landlords offer residents the opportunity to participate in rent reporting at the time of lease agreement and at least once annually thereafter. CredHub is an accredited rental reporting solution offering property managers the product and support to meet their legal obligations.

Access the best amenities and build a customized renter benefits package for your residents with these great partners.

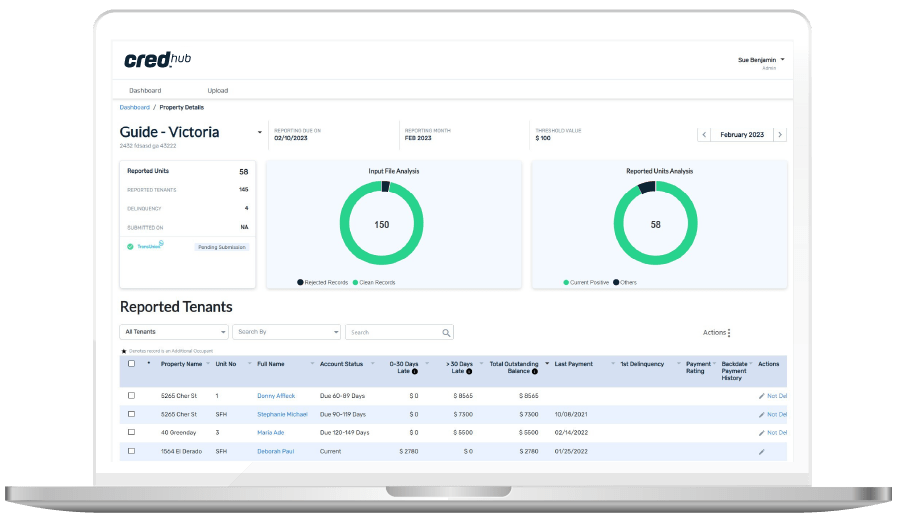

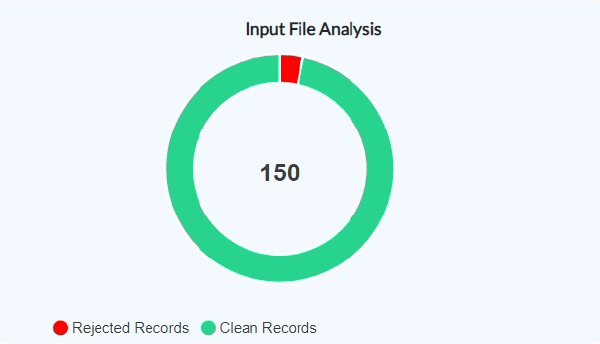

CredHub seamlessly and securely extracts the rental payment data each month from their partners property management systems. We upload it to our portal, where all you need to do, property manager, each month is review it. It takes less than 15 minutes per month. After you have reviewed data, the information is automatically transformed into each bureau’s proprietary format and reported to the credit bureaus. For more information, please review the How It Works page.

The CredHub platform is flexible, scalable, and can work with any property management system.

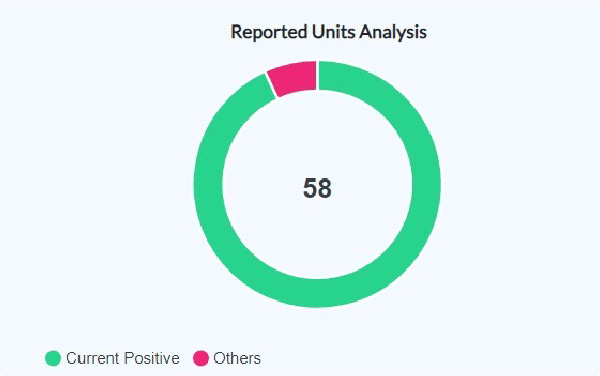

CredHub is credentialed to report to Equifax and TransUnion. Critical to CredHub helping reduce payment delinquency for property managers is reporting late and skipped payments. Both Equifax and TransUnion accept late and skipped payments as a factor in resident credit scores.

Property managers and landlords of all sizes can now have a relationship with the major credit bureaus by partnering with CredHub. CredHub does have a 50 unit minimum to get started.

CredHub will do the work to get your company up and running with the credit bureaus. It takes approximately three to six weeks to establish a tradeline

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the collection of consumers’ credit information and access to their credit reports. It was passed in 1970 to address the fairness, accuracy, and privacy of the personal information contained in the files of the credit reporting agencies. CredHub is FCRA compliant. CredHub also monitors all reporting recommendations provided by the Consumer Data Industry Association (CDIA) and interpreted by Equifax and TransUnion. In addition, we monitor state regulations in all the locations in which our clients do business.

CredHub monitors all reporting recommendations provided by the Consumer Data Industry Association (CDIA) and interpreted by Equifax and TransUnion. These reporting guidelines monitor all Fair Credit Reporting Act changes and are paralleled to comply with Federal and State eviction moratoriums. In our system if a payment is made, the financially responsible party will receive positive payment credit. If the payment is delinquent it is being added as a neutral in the monthly remark category. A neutral remark will not affect an individual credit score negatively however, no credit will be given for a payment that is not made. Post pandemic, there will be an option to use the negative reporting which will impact the individual’s credit to ensure rent remains a priority to pay of all outstanding debts.

CredHub’s end-to-end platform leverages an encryption process using symmetric key encryption and a 256-bit Advanced Encryption Standard (AES) algorithm that uses CBC mode, and a randomized, 128-bit initialization vector (IV) to encrypt field-level data, as well as any stored files. In addition, we maintain real-time audit logs to track key changes to sensitive information or access to PII, including the date, time, nature of change, etc. Securing your information is a top priority. Our service agreement specifically states that although we have access to sensitive materials we will not store, sell or distribute materials to anyone outside of our company and processing partners.

Our flexible platform allows the property management company to choose the monthly pull date as well as the threshold amount that is decided upon to be reported as negative. For example, elect to report no one negative if they owe you less than $100, we have the flexibility of setting that threshold number monthly. It takes seconds each month to point and click in our portal of information any resident that you would not like to report as negative, despite the fact they may owe more money than configured threshold.

CredHub handles all questions and disputes with your residents. We have an all access website at www.credhub.com, can be reached by phone at 1-833-888-CRED, or by email at [email protected]. If a correction may be needed on information that was inadvertently submitted to the credit bureaus, we will handle resolution for the resident.

Reporting residents’ largest monthly payment to build their credit score can save them thousands, even tens of thousands, on future purchases. This increased FICO score leads to lower interest rates, higher credit limits and additional lending resources.

We have partnered with InfoArmor (by Allstate) to provide ID theft protection and resolution services. Services include dark web monitoring, credit alerts, lost wallet protection, highly trained and certified recovery experts, and 24/7 U.S.-based customer care.

Our services have a set fee as we offer two programs. Some of our clients charge an additional monthly reporting service fee providing additional revenue per resident or include our services in a larger resident amenity package. In addition, adding CredHub services reduces delinquency lowering outstanding balances plus lowers eviction and collection costs.

WHAT ARE YOU WAITING FOR?

Let CredHub do the heavy lifting to improve revenue and retention with our renter opt-in program, marketing support, technology and account management.