PROPERTY MANAGER GUIDE

Rent Payment Credit Reporting Why Every Property Owner Should Offer It

If you own or manage property, you should strongly consider reporting your residents rent payments to the credit bureaus.

Why? Because doing so brings a long list of unique benefits to both you and your renter.

Adopting a resident credit reporting solution can:

Retain high quality renters and increase satisfaction

Increase your per-unit revenue

Reduce payment delinquency and post-move out collections

For all these reasons and more, rental property owners and managers across the country are increasingly using a credit reporting solution to report rent payments to the credit bureaus (Equifax, TransUnion and Experian). Best of all, resident credit reporting works for rental properties of all sizes. And with a turnkey solution like CredHub, you only spend around 15 minutes a month to manage it. Read on to find out how resident credit reporting can make your property more profitable and make your life as an owner/ manager less stressful.

50%

Average reduction in delinquency seen by CredHub’s clients once fully implemented

Attract higher quality residents

Credit reporting naturally attracts higher quality units. For this reason, many of CredHub’s clients advertise this solution as an amenity when creating vacancy listings. When you add ID theft protection to the mix, it makes for a very compelling value proposition for prospective units. In this way, CredHub’s unit credit reporting solution can help you fill vacancies faster and fill them with financially responsible residents who are motivated to improve and maintain their financial standing.

CredHub’s unit credit reporting solution can help you fill vacancies faster, and with better units.

Increase renter satisfaction

Unit credit reporting is an amenity. The more clearly you communicate this to your residents, the happier they’ll be with their rental agreement. With CredHub’s credit reporting system, every time a unit pays their rent on time, that payment is reported to Equifax, TransUnion, and Experian, positively affecting their score. Over time, financially responsible residents can build a strong credit history based on rent payments alone. This can have a tangible impact on your unit’s future. A strong credit history can mean a better chance of getting a car loan or other consumer loan (and most likely a better rate on that loan), and in some cases, even reduced insurance premiums. For financially responsible units, credit reporting for on-time payments can be a very attractive addition to your resident rewards package, or a great standalone incentive. CredHub also offers top-of-the-line identity theft protection from Allstate (with more features and at a lower cost than is available for retail purchase) — making our solution potentially even more attractive to current and prospective units.

Credit reporting for on-time payments can be a very attractive addition to your unit rewards package, or a great standalone incentive.

Get paid on time

Increasing on-time rent payments is the single biggest reason that property owners and managers are interested in unit credit reporting. Credit reporting creates an incentive for units to pay rent on-time. And the results prove that this incentive system works. CredHub’s clients see an average of 50% reduction in delinquency once fully implemented. But it’s about more than just money — it’s also about getting back time and lowering your stress level. Along with the increase in predictable revenue from on-time rent payments, property owners and managers love having fewer problematic accounts to handle. With fewer delinquent payments and less postmove-out collection issues, you’ll have more time to spend on important business initiatives — not to mention on your life outside work.

Raise your per-unit revenue

How much would you be willing to pay each month for the benefits listed above? $10 per resident? $15? How do you put a value on increased revenue combined with fewer management hassles and better-quality units? With CredHub, you don’t have to. That’s because you end up paying nothing at all — in fact, your revenue per unit increases.

Takes less than 15 minutes a month

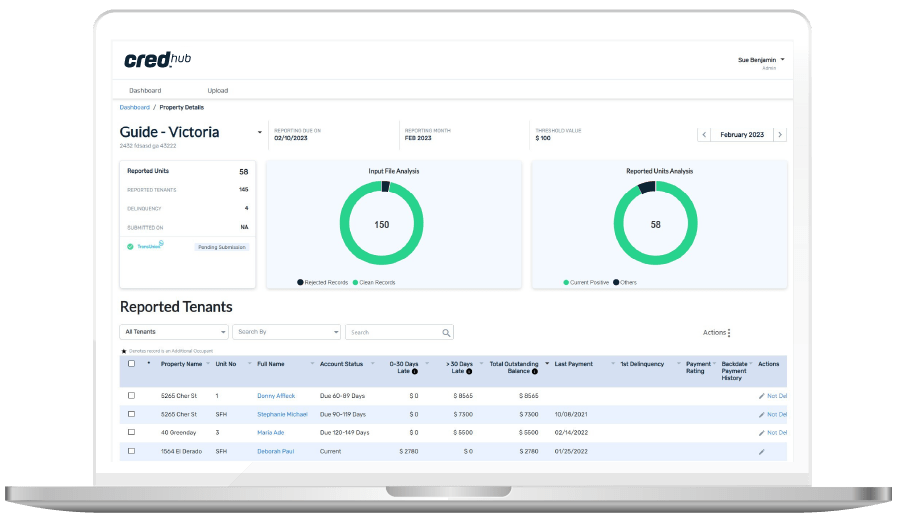

Most property owners and managers don’t have the time or the desire to learn how to report rent payments to the credit bureaus. Nor do they want to spend hours managing the process month after month. With CredHub, you don’t have to do either of these things. Other credit reporting solutions require you to do most of the work yourself. In many cases, you must manually submit payment info, often via spreadsheet or some other cumbersome format. CredHub, on the other hand, integrates directly with all the major property management software platforms. So, you don’t have to do any of the administrative or data entry work. Everything happens automatically. All you do is verify the information once a month, which typically takes 15 minutes or less. We handle everything else, including customer service and unit issues — freeing you up to focus on what matters most. CredHub charges a small per-unit fee for credit reporting and ID theft protection services. Property owners/managers in turn charge a slightly higher fee to their units for providing these amenities. So along with the myriad benefits CredHub provides to you and your units, you also get an extra revenue source for your business.

Contact CredHub for more information

We’ve shown you how unit rent payment reporting (and optional ID theft protection) from CredHub can help you raise your revenue, attract better units, fill vacancies faster and increase resident satisfaction. The benefits to both you and your residents are tremendous, which is why property owners and managers across the country turn to CredHub for monthly resident credit reporting.

Learn more about how CredHub can help you improve your rental experience.

Download the guide